People are starting to feel more optimistic about the UK property market.

A recent survey by HSBC found that 68% of first-time buyers are now more confident about getting on the property ladder.

This is likely due to mortgage rates beginning to fall and house prices normalising.

According to the Office for National Statistics (ONS), the average UK house prices decreased by 1.2% in the 12 months to October 2023.

However, getting a mortgage as an expat is often more complex.

In this article, we look at how to get on the UK property ladder as an expat.

How to Get on the UK Property Ladder as an Expat

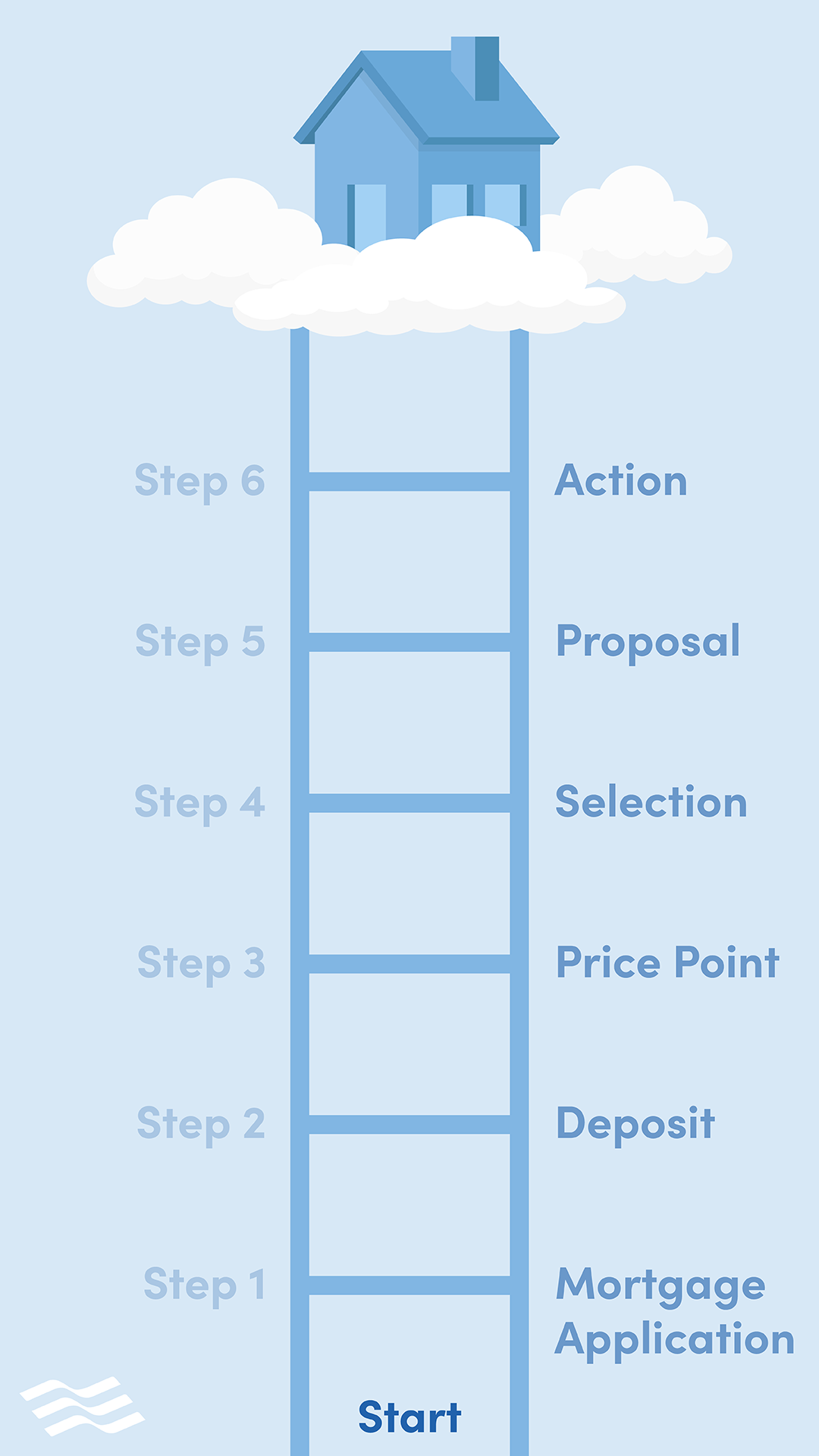

Below is our step-by-step guide on how to get on the UK property ladder as an expat.

Step 1 – The Mortgage Application

There are over thirty mortgage lenders that help buyers purchase property in the UK. And as an expat, getting on that first rung of the ladder is to get a Mortgage in Principle.

At Holborn, we have mortgage brokers who can provide advice and assist you in securing a mortgage. Expat lenders take into consideration the following:

- Where you were born

- Where you live now

- Your occupation

- Yours and your spouse’s salary/income

- Your age

They can then calculate the amount you can borrow. Currently, lenders lend up to 70% of the property purchase price.

Step 2 – Deposit

Expat mortgage lenders in the UK look for a larger deposit, usually a minimum of 30%. But remember, other costs are involved in a purchase. These include:

- Stamp Duty

- Solicitor costs

- Lenders fees

- Valuation fees

These fees will depend on the client’s status. As a rule of thumb, 8% of the purchase price would be a good indication.

Step 3 – Price Point

At Holborn, we have residential properties from GBP150,000 up to GBP4,000,000.

After going through the mortgage process and getting your “Decision in Principle”, we can identify the price point that matches your budget.

Step 4- Selection

Now, we get to the interesting and more enjoyable part – selecting the right property for you.

At Holborn, our “off-plan” properties must meet our rigorous criteria. They must tick 30 key boxes before putting them on our menu. These include:

- Financial strength of the developer

- Planning consent

- Location

- Demand for homes in the housing market

- Key employers in the area

We have opportunities in Edinburgh, York, Manchester, Birmingham, London and Brighton. We also offer a “Property Search” facility.

Step 5 – The Proposal

At this stage, we know the budget and the preferred geographic area.

With this information, we put together a proposal. This would include details of the property, floorplans, white goods included and a thorough cash flow.

The cash flow shows when payment needs to be made, typically 10pc on exchange and future stage payments. It will also show solicitor fees and the costs and income going forward. We aim to be “cash flow neutral”, depending on mortgage loan-to-value and interest rates.

Step 6 – Action

With the property selected and the mortgage pre-approved, we are ready to go.

At Holborn, we introduce you to a solicitor who acts for you and takes care of the legal aspects of the purchase transaction. They liaise between you, the developer and the lender.

Throughout the journey, Holborn is by your side. Our specialist team will provide expert advice and ensure a smooth process from start to finish.

What is an Expat Mortgage?

High street lenders such as banks and building societies are often reluctant to lend to expats as they perceive them as higher risks.

However, solutions exist for those looking to get on the UK property ladder.

An expat mortgage is a type of mortgage product aimed at non-UK nationals or British citizens living overseas. It allows them to purchase property in the UK.

People can access these products through expat mortgage brokers. These specialist brokers are better equipped to deal with overseas residents looking to buy property in the UK.

Typically, these specialist lenders offer two main types of mortgage products. They are:

Buy-to-let mortgages

A buy-to-let property is one that you intend to rent out to tenants and earn a rental income from. A rental property requires a buy-to-let mortgage.

Residential mortgages

These are the standard mortgages needed to buy a home you intend to live in.

Getting on the Property Ladder with Holborn Assets

Buying UK property can be more challenging if you are a non-UK citizen or a British expat currently overseas.

Each bank has its own lending criteria and may have additional requirements. That is why speaking with an expert who understands how to get on the UK property ladder as an expat is essential.

A specialist expat mortgage adviser will understand the lender requirements and what is needed to successfully secure a mortgage. They can provide the advice you need based on your individual circumstances and help you access the best mortgage rates on the market.

If you are looking to get your foot on the first rung of the ladder, we can help.

Holborn Property Investments is a part of the wider Holborn Assets Group, an international, award-winning financial services company.

We work with some of the most prestigious UK and international property developers to offer clients an exclusive range of off-plan and completed developments.

Through our partnerships and relationships with providers, developers, mortgage brokers and legal professionals, clients benefit from a comprehensive service.

This includes helping them to secure the best expat mortgage deals and working closely with them from the application process to completion.

For more information, contact our team to learn how we can help you get on the UK property ladder.