Property is a hot commodity, with house prices soaring in 2022.

House prices have gone up 13.6% year on year, according to the House Price Index. When it comes to UK property investment, this is good news, from a capital growth standpoint, at least.

With property investing, the challenge has always been finding the right location that generates the best returns. Based on the latest data, it could be time for property investors to turn their attention to British cities.

In this article, we look at the increasing demand for city locations and what this means for your capital growth potential as an investor.

What is capital growth?

Along with rental yield, capital growth is one of the key factors for determining the overall return on investment.

Capital growth simply refers to an asset or investment increasing in value over a period of time.

A percentage is typically used when talking about capital growth. It is calculated by finding the difference between the current market value and the purchase price.

Working out capital growth is straightforward.

Let's say you bought a house in 2018 for £225,000. In 2022, the property is now worth £300,000, and you decide to sell. Your capital growth returns would be £75,000, or just over 33%.

- Price now (£300,000) – purchase price (£225,000) = (increase) £75,000

- Increase (£75,000) / purchase price (£225,000) = 0.333

- 0.333 x 100 = 33.3%

Remember, any profit you make when selling a property is usually subject to capital gains tax. This tax applies when you sell an asset that has increased in value.

Cities vs suburbs

Since the country opened back up following the pandemic, the UK property market has gone from strength to strength. This year alone, residential property values have seen a rapid increase.

The latest figures from the Office for National Statistics (ONS) show that average house prices have increased by 13.6% in 2022 compared to the previous year.

However, a separate report from Halifax found that demand for homes in British cities was the driving force behind this year's soaring house price inflation.

According to the banking group's findings, the average house price growth in cities has risen by 9.2% since the start of the year. Meanwhile, areas surrounding those cities only saw a 7.9% increase over the same period.

This is in stark contrast to how the housing market looked just a couple of years ago. The question is, what has changed?

Change of priorities

During the pandemic, buyers looked to rural and suburban areas, seeking outdoor space and bigger homes.

With the country locked down and access to amenities restricted, cities and urban areas declined in popularity.

For first-time buyers, getting on the property ladder was more manageable in areas outside of big cities. Plus, they could get more for their money.

As a result, property prices in suburban and rural areas saw stronger growth.

However, at the start of 2022, the country started to return to normality. People began returning to the office to work, and cities opened up once more.

All of this has culminated in rental and buyer demand increasing in city locations.

Where are house prices increasing the most?

Several factors determine what makes a good investment property. But focusing on annual house price growth alone, we can see that some cities have seen sharp rises this year.

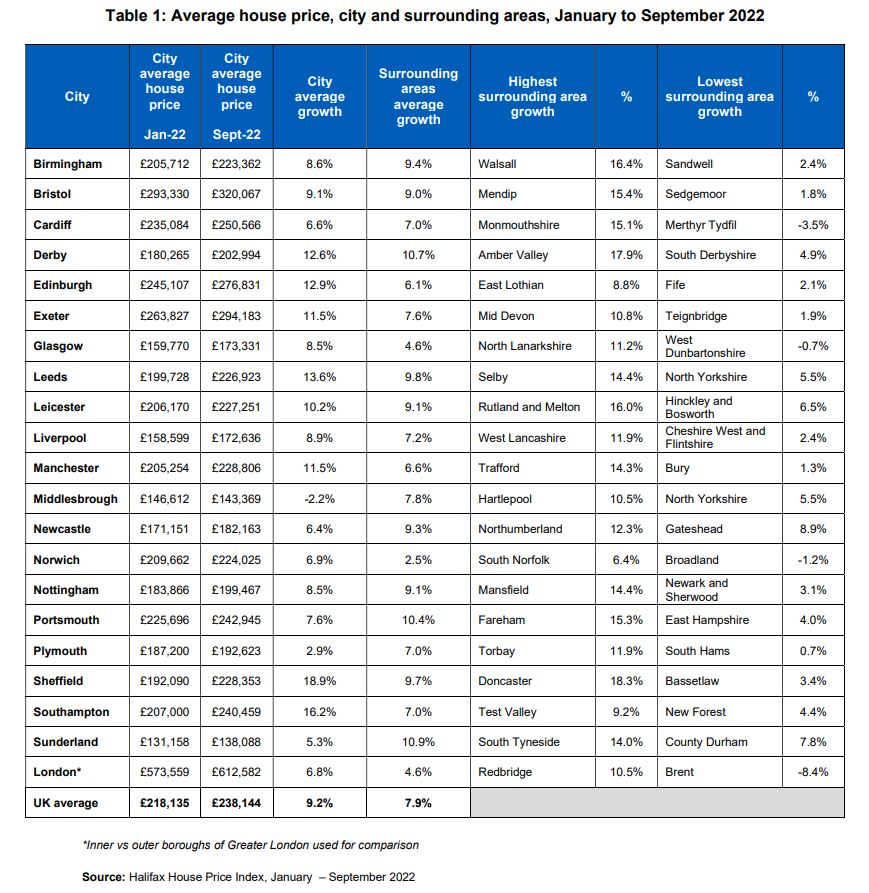

According to the Halifax House Price Index, the average property prices have increased from £218,135 in January to £238,144 in September.

Sheffield saw the biggest property price growth. Prices in the city increased by 18.9% this year. Average prices in the city are around £228,353, lower than the UK city average.

Southampton saw the most significant increase in the South East. House prices in the city climbed 16.2% to £240,459 – a little over the UK average.

Elsewhere, the North West has also performed well. Manchester and Liverpool have grown by 11.5% and 8.9%, respectively.

Cities in the North East saw slower growth. In Newcastle, the average prices increase by 6.4%. However, it is worth bearing in mind that the entry level for investors is much lower, with the average house price in Newcastle being just over £183,000.

In the East Midlands and West Midlands, cities such as Birmingham saw a lower increase in capital growth at 8.6%. However, the city does have one of the best average rental yields across the UK.

The table below shows a full breakdown by city and the surrounding areas.

Will house prices continue to rise?

In an effort to curb soaring inflation, the Bank of England (BoE) has continued to increase the base rate throughout 2022. The central bank's base interest rate is now at 3% at the time of writing.

With a large enough deposit, mortgage rates are still relatively low, all things considered. However, further increases to the base rate are expected.

As a result, mortgage interest rates will continue to go up. Ultimately, this means an increase in mortgage repayments, which could dampen the UK housing market.

Going into 2023, we may not see the same increases, especially with the cost of living crisis showing no signs of slowing down.

Regardless, there is more than capital growth to consider when investing in a buy-to-let property. While some locations may have a lower capital growth rate than others, the average rental yield may be higher.

As we saw, Newcastle and Birmingham saw lower capital growth rates compared with other UK cities. Despite this, both locations produce some of the best rental returns.

Like investing in the stock market, property is typically considered a long-term investment. Locations that produce a higher rental income could be a profitable option in the long run, even if capital growth is lower.

Investing with Holborn Property

At Holborn, we work with some of the leading developers. This allows us to offer clients exclusive investment properties in key locations across the UK and internationally.

We also offer clients a range of property investment strategies to meet their needs.

Start building your property portfolio with Holborn. Contact us using the form below and find out how we can help you.