The UK housing market has bounced back considerably since the start of the pandemic. It seems to be the same story with buy-to-let properties.

In March 2021, one year after the first lockdown, lenders launched 200 new buy-to-let mortgages. The increase means landlords have more mortgage options than at any other time in the last 12 months.

All of this is great news for those investing in the UK property market. However, the area you choose to buy in can make a big difference in your overall return.

In this article, we look at some of the best regions in the UK based on rental yield.

What is rental yield?

With property, two sources determine your investment income – capital growth and rental yield. For this reason, rental yield is a crucial metric for investors when it comes to a buy-to-let property.

Rental yield is essentially your return on investment. In this case, how much you can expect to make from rent payments when measured against the price you paid for the property and other factors.

Working out the rental yield is straightforward. Simply take the annual rental income amount and divide it by the purchase price of the property. You can then multiply that number by 100, and you have your rental yield.

Of course, there is a little more to factor in, such as unexpected repairs, insurance and other costs. This is where it is important to understand the difference between gross and net yields.

Gross yields are simply the rental income versus property price. On the other hand, net yields are a more accurate depiction of your return on investment as they account for additional costs.

The best rental yields by region

Property prices in the UK have exploded since the pandemic.

According to data from Rightmove, the average property price in the UK is £336,073. However, that is the average across the UK, and soaring prices in London have certainly helped inflate that number.

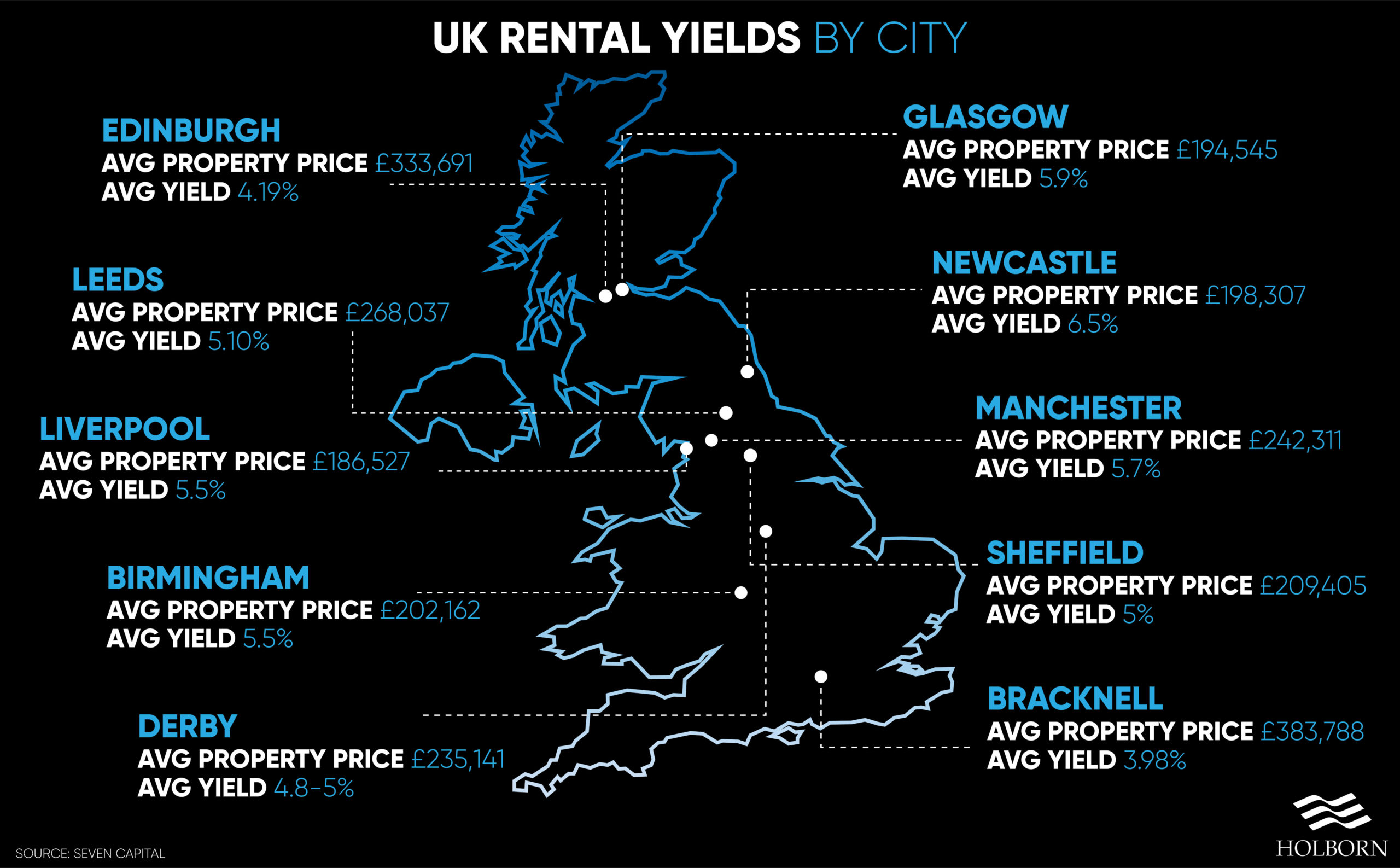

Other cities across the UK have a much lower average price. It is in these key locations where investors are benefiting from excellent rental yields.

The graphic below shows some of the best locations in the UK based on rental yield.

Buy-to-let in 2021 and beyond

Property prices in the UK have soared in recent months. With house prices at an all-time high, Property Partner for Holborn Assets, Chris Allen, believes the reason is simple.

“The landscape for 2021 has been incredibly strong already, helped by government incentives.

“Still, the main thing (about the UK property market) is supply and demand – there just is not enough supply for the demand.”

Of course, the main concern for most will be the idea that this could be a bubble waiting to burst. However, Chris believes the strong performance of the UK housing market is set to continue beyond 2021.

“If you look back at every five year period in the housing market going back to when records began, you’ve always seen an uptick. Property remains a good, solid investment.

“In a lot of locations, I see the fantastic potential for both capital growth and rental yield.

“Thanks to the infrastructure links such as HS2, areas such as Birmingham, York and the north of England present incredible investment opportunities.”

Expert advice

Investing in bricks and mortar has long been a popular addition to people’s portfolios.

Still, speaking with a specialist is the best way to ensure you find the right buy-to-let investment based on your circumstances.

Our team of experts offer a complete investment solution for those looking to add property to their portfolio. We only work with the most trusted developers to bring you exclusive investment opportunities.

Holborn Assets Property is part of the larger Holborn Assets group. For over 20 years, Holborn Assets has been one of the leading financial services companies trusted by clients across the globe.

For more information or to find out how we can help you, contact us using the form below.